Published July 10, 2022 1:50 pm est

Editor in Chief,

NewsMovesmarketsForex

KEY TAKE AWAYS:

- U.S. Jobs report rose by 372,000 new jobs added to the U.S. Labor Markets in the Month of June 2022, cementing down three consecutive months of positive U.S. Job growth

- June 2022 Labor participation still remains flat and unchanged at 62.2 percent

- Unemployment rate stayed the same coming in at 3.6% for the month of June 2022

- Average hourly earning for employees on private nonfarm payrolls in June rose by 10 cents or .3%

- June Joblessness numbers for Blacks remain pretty much unchanged at 5.9% while Hispanics remain unchanged at 4.3 percent respectively

- Positive Job Gains in professional and business services, Leisure and hospitality, and healthcare

U.S. Jobs Bounce by a resounding 372,000 new essential JOBS added to U.S. Labor markets for the month of June of 2022. The U.S. Labor market appears to be cranking up with a solid three consecutive months of positive jobs growth injecting a bit of positive liquidity into the U.S. Labor markets.

Considering the dismal possibilities of recessionary over tones looming right around the conner and despite the positive jobs report numbers, amid beating wall street economist expectations by 4,000 jobs in the month of June.

There still is that lingering problem according to World renown ADM Economic Strategist Marc Ostawald, who emphasizes that: “the Participation Rate which at 62.3% is 1.0 ppt below pre-pandemic levels, they have been hoping that there would be more workers returning to the labor force to ease shortages”.

In retrospect it is crystal clear that there is a untethered moderate trend of a significant imbalance in the over all U.S. worker pool as it relates to Employers still having a tough time locating people to fill expanding job openings.

Unemployment consistently remains unchanged for the fourth consecutive month this year at a rate of 3.6 percent.

Historical 40 year record High Inflation Still Unchanged despite Strong June Job Numbers

Once again as noted in our last Jobs report that was written in the month of May 2022, which covers the following: U.S. Jobs report POPS OFF Adding 428,000 new Jobs to Economy, Unemployment unchanged at 3.6 percent catch the full story here.

The antagonist or the Bad Guy in the U.S. Economy, is none other than, ” Mr. Runaway Inflation”- which has disproportionately hit historical 40 year high’s of 6.6 percent.

Sky Rocketing inflation is currently being perpetuated by the Russian invasion of Ukraine. Furthermore; the China COVID-19 lock downs continues to stifle and plug up global supply chains across wide stream economies, causing massive turmoil propelling the cost of Energy, fuel, food, as well other commodities, respectively.

Despite previous vigorous economic jobs growth and worker hourly average earning improvements unemployment continues to remain flat with various consecutive months of Unemployment rate settling at the same rate of Junes 2022 rate of 3.6 percent.

Black unemployment improve fractionally from the previous month coming in at 5.9% in the month of June 2022, compared to May numbers of 6.2 percent .

Hispanics unemployment rate reports 4. 3 percent remain unchanged from previous month. BLS did also reported that the Labor Participation rate displayed no movement from the previous month coming in at 62.2 percent for June with little to no change than the previous month.

Labor Participation Rate, Worker Average Earnings

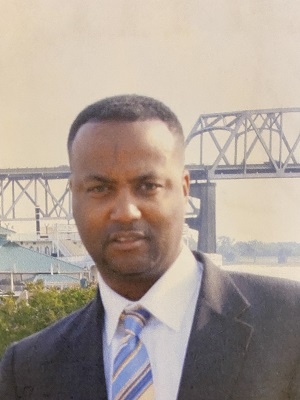

I specially asked world renowned economist Marc Ostwald who is an expert Chief Economist & Global Strategist with ADM Investor Services International head quartered in London England,  for his take and insights on the June ‘s U.S. Labor Market Jobs Report results and Mr. Ostwald stated:

for his take and insights on the June ‘s U.S. Labor Market Jobs Report results and Mr. Ostwald stated:

“US labor data: the consensus looks for Payrolls growth to slow to 250K vs. a 3-mth average of 408K, so this would be a marked slowdown, but payrolls are anything but the be all and end all for the Fed.

They will be focused above all on the Participation Rate which at 62.3% is 1.0 ppt below pre-pandemic levels, they have been hoping that there would be more workers returning to the labor force to ease shortages, but a combination of ‘boomers’ retiring (i.e. demographics), some households needing a parent to stay at home given continued health concerns, and others simply taking a different view about working, this has not been the case, or at least not to the extent they had hoped.

They will also be focused on Avg Hourly Earnings, which are expected to rise 0.3% m/m for a third month and signaling moderation in wage pressures, though ideally they would prefer 0.2% m/m as an average. Any downside surprises would likely see markets push back harder on the Fed’s rate trajectory. Anecdotal evidence does point to some easing in labor market pressures.”

“WHATS UP WITH THE MARKET”

Currency Markets reactions to Job numbers overtime has been mixed and sporadic with the U.S. Dollar index currently up on the day at .001% DXY trading 103.69 as of this writing.

The DXY Index is trading Ten percent higher than October 8, 2021 Jobs Report rate results of 94.11, Check out the full story here (U.S. Jobs Report Falls 194,000 Job, Unemployment 4.8% Sep) .

Many of the mainstream currencies are slightly bouncing of the lows of Friday’s FX market close EUR weakening across a currency board spectrum:

EUR stronger than the USD trading at 1.01830 (EURUSD .33% up) CAD stronger than the EUR trading at 1.3601 (EURCAD -0.07% down) USD Weaker than CAD trading @ 1.2949 (USDCAD -.18% down), USD weaker than the CHF trading at .98672 (USDCHF .28% up the day). AUD weaker than the U.S. Dollar trading at 0.68560 (AUDUSD .33% up – on the trading day).

Covid Impact on the U.S. Economy

As of this date there have been 1.02M deaths and 88,400 confirmed infection cases, reported in the U.S. related directly to the Coronavirus pandemic.

According to the Bureau of Labor and Statistics in June of 2022, reported 7.1 percent of employed persons teleworked from home because of the coronavirus pandemic, down by .3 percent from the previous month in May, 10 percent less than the previous Month. Additionally, 2.1 million people reported that they had been unable to work because their employer closed or lost business due to the pandemic; number is 400k higher than the April’s 20222 report of 1.7 M.

June 2022 Job report

Major Worker Groups

- Additionally, according to the United States Bureau of Labor Statistics ...Please click here to see the previous month 2022 Major Workers Group Data) …The unemployment rates for June 2022 Major Worker Groups..Adults men 3.3%, – slightly lower than Apr 2022 at 3.5% Adult women 3.3% -slightly higher than Apr 2022 which was 3.2%, Teenagers 11.0% – .8% higher from Apr 2022 rate of 10.2%, Whites 3.3% -a fraction higher from Apr 2022 3.2%, Blacks 5.8% – slight fraction lower from Apr 2022 5.9% rate, Asians 3.0% slightly lower than Apr 2022 rate of 2.8%, and Hispanics 4.3% -slightly higher than Apr 2022 rate of 4.1%.

For more Developing intriguing Central Bank Stories be sure to visit our Central Bank Breaking News Here:

News Moves Markets Forex “real time digital currency news”, works to provide market intelligence, connecting our audience with a mix of the most latest insightful currency news in the Foreign exchange markets. Providing the Latest and the greatest in depth developing global central bank stories and financial news to traders and investors around the continent.

News Moves Markets Forex “real time digital currency news”, works to provide market intelligence, connecting our audience with a mix of the most latest insightful currency news in the Foreign exchange markets. Providing the Latest and the greatest in depth developing global central bank stories and financial news to traders and investors around the continent.

Connecting People to the markets through the power of information from a Black perspective.

Expert Economist: Marc Ostwald an expert Chief Economist & Global Strategist with ADM Investor Services International

Marc Osterwall is a world renowned Expert Economist who Analyzes and forecast macro/microeconomic trends and central bank policies on a exponential economic level. Mr. Osterwall is a regular guest on Bloomberg BNN, HT & Radio, BBC, CNBC, Le Fonti International and is widely quoted on newswires, newspapers, and other digital media worldwide. He is also a regular conference speaker and guest lecturer at various universities.

Reference: U.S. Bureau of Labor and Statistics. (2022). Employment Situation Summary Retrieved from https://www.bls.gov/news.release/empsit.nr0.