Published: June 26, 2019 9:00 AM EST

by Richard Cason, Editor

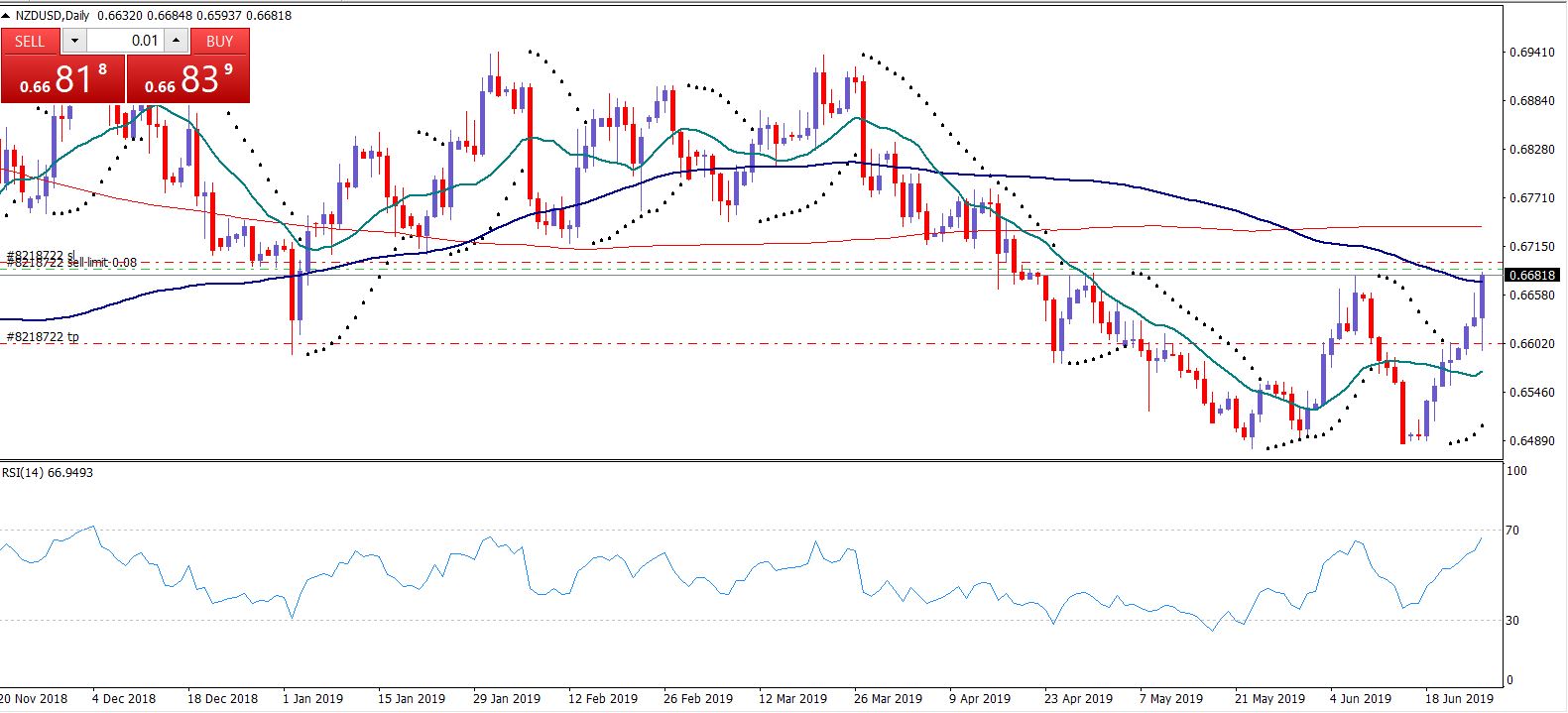

Republic Bank of New Zealand (RBNZ) Leaves Official cash rates unchanged at 1.50%, NZD USD set a two month high on June 26, 2019. NZDUSD retreats 70 pips from .6664 to .6594 handle after the RBNZ economic news release then begins a Bullish push overnight to a high of .6681 as of this writing.

The RBNZ lowered the interest rate back in May 2019 on its previous Monetary Policy Meeting due domestic inflation and global economic growth concerns.

Which appears to have provided a temporary bullish footing to the KIWI thus far. See full the story: RBNZ Cuts Rates.25% bases points, NZD USD Sets 7 month LowNZD USD sets seven month Lows on May 7, 2019. NZD immediately retreats 79 pips to.6524 handle .

NZD USD Eyeing Yearly Quarterly Highs of .6694 Set on April 19, 2019:

The NZD USD has been trading within an 87 pip range in the last 24 hours between a intraday low of .6594 and a high of .6681. On the One Hour Chart the Pair has Nine bullish candles to the right eyeing the quarterly Highs of the year of .6694 set back on April 19, 2019.

RBNZ OCR DECISION

The New Zealand Monetary Policy Committee said that OCR will remain unchanged at 1.50%..“Given the weaker global economic outlook and the risk of ongoing subdued domestic growth, a lower OCR may be needed over time to continue to meet our objectives.

Domestic growth has slowed over the past year. While construction activity strengthened in the March 2019 quarter, growth in the services sector continued to slow. Softer house prices and subdued business sentiment continue to dampen domestic spending.

The global economic outlook has weakened, and downside risks related to trade activity have intensified. A number of central banks are easing their monetary policy settings to support demand. The weaker global economy is affecting New Zealand through a range of trade, financial, and confidence channels.

We expect low interest rates and increased government spending to support a lift in economic growth and employment. Inflation is expected to rise to the 2 percent mid-point of our target range, and employment to remain near its maximum sustainable level.

Given the downside risks around the employment and inflation outlook, a lower OCR may be needed.

NZD USD WhipSaws to .6594 from a high of .6664 After RBNZ allows Rates unchanged 1.5%

The Kiwi against its rival the Green Back is currently trading in a range between .6594 and .6684 in the U.S. tradimg session as of 08.45 am est. The currency is trading well above the 100, and the 200 day Simple Moving Average and the RSI is reading 70.87 as of this writing.

#usdnzd #traders #currencymarkets #nzdnews #rbnz #forextrading